YouTubers are full of negativity. Recession is near! Be ready! This is scary! Sell your stocks! The economy is bad! Well, everything isn`t good, but the growth in the U.S. is still very good. Just take a look at the numbers.

More good news came out earlier today. The U.S. job market in October 2024 has shown surprising strength, with 254,000 new jobs added in September. Far exceeding expectations. This strong growth brings the unemployment rate down to 4.1% (which is relatively low historically), and hourly wages are growing at an annual rate of 4%.

Economists expected slower growth, but these numbers indicate that the U.S. economy continues to perform well, and there’s optimism about avoiding a recession. However, voter sentiment still lags, as many remain concerned about inflation and the broader economic outlook

Not only the U.S. stock market is going up. Take a look at the China Stock Market. The China Stock Market has gone down and sideways for about 18 months but took back that downturn within a couple of weeks. This is amazing.

The recent surge in China’s stock market over the past two weeks is likely driven by several factors, including improved investor sentiment, government stimulus measures, and better-than-expected economic data. China’s government has implemented policies to stabilize the property sector, cut interest rates, and support industries, encouraging domestic investment.

Additionally, optimism about easing geopolitical tensions and a potential economic rebound is fueling this upward momentum. However, concerns remain about long-term growth and regulatory uncertainties, which could influence future market performance.

But China is not alone. ECB is doing the same. BOJ is doing the same, and so is the FED among many others. New money is coming into the stock market, and the stock market continues to climb higher.

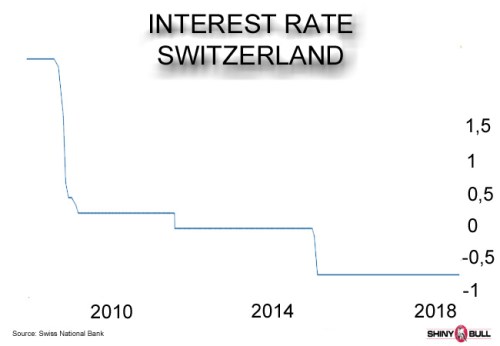

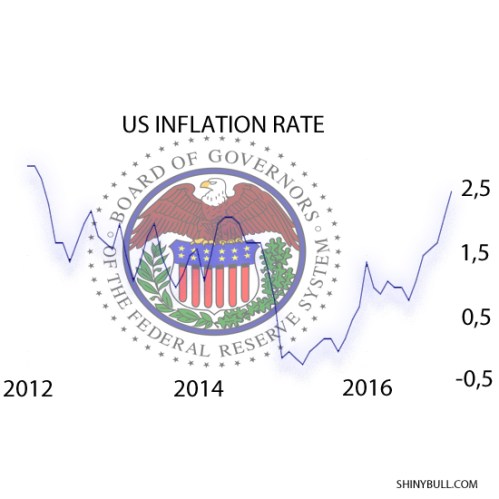

The massive printing of $21.17 trillion by the U.S. and other central banks, mainly in response to crises like the pandemic, significantly increased liquidity in the global financial system. This money printing was aimed at stimulating economies, propping up financial markets, and providing emergency relief. However, it also led to inflationary pressures as too much money chased too few goods.

The excess liquidity fueled asset bubbles raised debt levels and forced central banks to later tighten policies to combat the resultant inflation. Balancing liquidity while avoiding hyperinflation remains challenging.

The U.S. most recently engaged in significant money printing during the COVID-19 pandemic, particularly in 2020 and 2021, through measures such as the Federal Reserve’s Quantitative Easing (QE) program.

As of July 2024, the M1 money supply (monthly supply) in the United States stood at approximately 18 trillion dollars, marking a significant decrease from the previous year. This decline followed a notable contraction in the M1 money supply during the latter half of 2022 and the first six months of 2023.

The Fed injected trillions of dollars into the economy by purchasing government bonds and mortgage-backed securities to maintain liquidity, lower interest rates, and stimulate growth. By mid-2021, the Fed had expanded its balance sheet by over $4 trillion. However, exact figures for ongoing or current printing efforts are often adjusted depending on economic conditions.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Shinybull.com. The author has made every effort to ensure the accuracy of the information provided; however, neither Shinybull.com nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in precious metal products, commodities, securities, or other financial instruments. Shinybull.com and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.