On February 25, 2026, President Donald J. Trump delivered what became the longest State of the Union address in American history. He opened with a bold declaration:

“America is back, bigger, better, richer, and stronger than ever before.”

It was a sweeping and confident beginning, setting the tone for a speech built around economic revival, national strength, faith, and America’s global role.

The “Golden Age” Narrative

Trump framed his presidency within a larger historical milestone: the upcoming 250th anniversary of American independence.

He called the July 4 celebration an “epic milestone” marking “two and a half centuries of liberty, triumph, progress, and freedom in the most exceptional nation ever to exist.” According to the President, the country has entered what he described as “the golden age of America.”

The message was clear: this administration sees itself not as managing decline, but as leading a historic resurgence.

Economic Turnaround: Inflation, Energy, Markets

A central focus of the speech was the economy.

Trump sharply criticized the Biden administration, blaming it for what he described as historic inflation and rising living costs. He claimed that within one year of his return to office, core inflation had fallen to 1.7% in late 2025. The lowest level in more than five years.

Energy prices were another key talking point. Trump stated that gasoline prices, which had peaked above $6 per gallon in some states, had dropped below $2.30 in most areas, with even lower prices in parts of the country.

He also highlighted:

- Mortgage rates at a four-year low

- A significant reduction in annual mortgage costs

- 53 stock market record highs since the election

- Over $18 trillion in new investment commitments

The President argued that these indicators represent the “biggest economic turnaround in history.”

He credited tariffs as a major driver of this growth, claiming they generated hundreds of billions of dollars in revenue while strengthening national security and improving trade terms. He used tariffs as a weapn to make countries to negotiate better deal, and Trump made it.

Tax Cuts and Deregulation

Trump praised what he described as the largest tax cuts in American history, passed with Republican support.

Among the measures he highlighted:

- No tax on tips

- No tax on overtime

- No tax on Social Security benefits

- Tax-deductible interest on auto loans for American-made vehicles

He also emphasized regulatory rollbacks, claiming record reductions in “job-killing regulations” and stating that all job growth under his administration has been in the private sector.

Healthcare and Prescription Drugs

Another major theme was healthcare reform.

Trump criticized the Affordable Care Act, arguing that insurance companies benefited more than ordinary Americans. He proposed redirecting government payments directly to individuals to purchase their own insurance.

He also touted newly implemented “Most-Favored Nation” drug pricing agreements, claiming that Americans would now pay the lowest prescription drug prices in the world. A dramatic shift from previously paying the highest.

Foreign Policy and Military Strength

On foreign policy, Trump claimed to have ended eight conflicts within his first ten months in office, naming disputes across Asia, Europe, Africa, and the Middle East. He stated that efforts are ongoing to end the war between Russia and Ukraine.

He also referenced a military operation targeting Iran’s nuclear program, reaffirming his long-standing position that Iran must never obtain a nuclear weapon. At the same time, he expressed openness to diplomacy.

Trump emphasized a policy of “peace through strength,” noting a trillion-dollar defense budget and increased NATO defense spending commitments.

Faith and National Identity

The President spoke at length about what he described as a renewal of faith and religion in America, particularly among young people. He called for national unity, a rejection of political violence, and reaffirmed the phrase “one nation under God.”

Throughout the speech, Trump returned to themes of American exceptionalism, resilience, and destiny.

A Historic Framing

The address concluded with sweeping historical imagery. From the Founding Fathers to industrial expansion, global conflicts, space exploration, and cultural influence.

Trump described the first 250 years of American history as only the beginning, declaring:

“The golden age of America is upon us.”

The speech was ambitious in scope, blending economic data, political contrasts, national pride, and religious undertones into a narrative of revival and strength.

Whether one views it as bold leadership or partisan rhetoric, the message was unmistakable: this administration believes it is presiding over a defining chapter in American history.

Here is the speech in Trump`s words:

President Donald J. Trump held a State of the Union speech on February 25, 2026, and he started the speech by saying that the U.S is back, bigger, better, richer, and stronger than ever before. A brilliant start for the longest State of the Union speech in U.S. history.

Then he followed up by saying that «Less than five months from now, our country will celebrate an epic milestone in American history: the 250th anniversary of our glorious American independence. This July 4th, we will mark two and a half centuries of liberty and triumph, progress and freedom in the most incredible and exceptional nation ever to exist on the face of the earth, and you’ve seen nothing yet. We’re going to do better and better and better. This is the golden age of America.»

The Economy is important for Americans, and Trump talked about Biden, inflation, gasolin and mortgage and housing prices.

The Biden Administration and its allies in Congress, gave us the worst inflation in the history of our country. But in 12 months, my Administration has driven core inflation down to the lowest level in more than five years. And in the last three months of 2025, it was down to 1.7%. Gasoline, which reached a peak of over $6 a gallon in some states under my predecessor—it was quite honestly, a disaster—is now below $2.30 a gallon in most states, and in some places $1.99 a gallon. And when I visited the great state of Iowa just a few weeks ago, I even saw $1.85 a gallon for gasoline.

Mortgage rates are the lowest in four years and falling fast. And the annual cost of a typical new mortgage is down almost $5,000 just since I took office. One year. And low interest rates will solve the Biden-created housing problem, while at the same time, protecting the values of those people who already own a house that really feel rich for the first time in their lives. We want to protect those values. We want to keep those values up. We’re going to do both, and we are going to keep it that way. The stock market has set 53 all-time record highs since the election—think of that, one year—boosting pensions, 401(k)s, and retirement accounts for the millions and millions of Americans, they’re all gaining. Everybody’s up—way up. In four long years, the last Administration got less than $1 trillion in new investment in the United States. And when I say less, substantially less. In 12 months, I secured commitments for more than $18 trillion pouring in from all over the globe. Think of it: much less than $1 trillion for four years versus much more than $18 trillion for one year. What a difference a President makes.

A short time ago, we were a dead country. Now, we are the hottest country anywhere in the world. The hottest, Trump said.

As thousands of new businesses are forming and factories, plants and laboratories are being built, we have added 70,000 new construction jobs in just a very short period of time. Getting bigger and bigger and stronger. Nobody can believe what they’re watching. American oil production is up by more than 600,000 barrels a day, and we just received, from our new friend and partner Venezuela, more than 80 million barrels of oil. American natural gas production is at an all-time high because I kept my promise to “drill, baby, drill.”

More Americans are working today than at any time in the history of our country. Think about that: any time in the history of our country, more working today. And 100% of all jobs created under my Administration have been in the private sector. We ended DEI in America. We cut a record number of job-killing regulations. And in one year, we have lifted 2.4 million Americans, a record, off of food stamps. And for all of these reasons, I say tonight, members of Congress, the state of our union is strong.

From 1776 to today, every generation of Americans has stepped forward to defend life, liberty, and the pursuit of happiness. And they’re really doing it for the next generation. But now it’s our turn. Together, we’re building a nation where every child has the chance to reach higher and go further,

Last year, I urged this Congress to begin the mission by passing the largest tax cuts in American history, and our Republican majorities delivered so beautifully. Thank you, Republicans. All Democrats, every single one of them, voted against these really important and very necessary massive tax cuts. They wanted large-scale tax increases to hurt the people instead. But we held strong and with the great Big, Beautiful Bill, we gave you no tax on tips, no tax on overtime, and no tax on Social Security for our great seniors. And we also made interest on auto loans tax-deductible the first time, but only if the car is made in America.

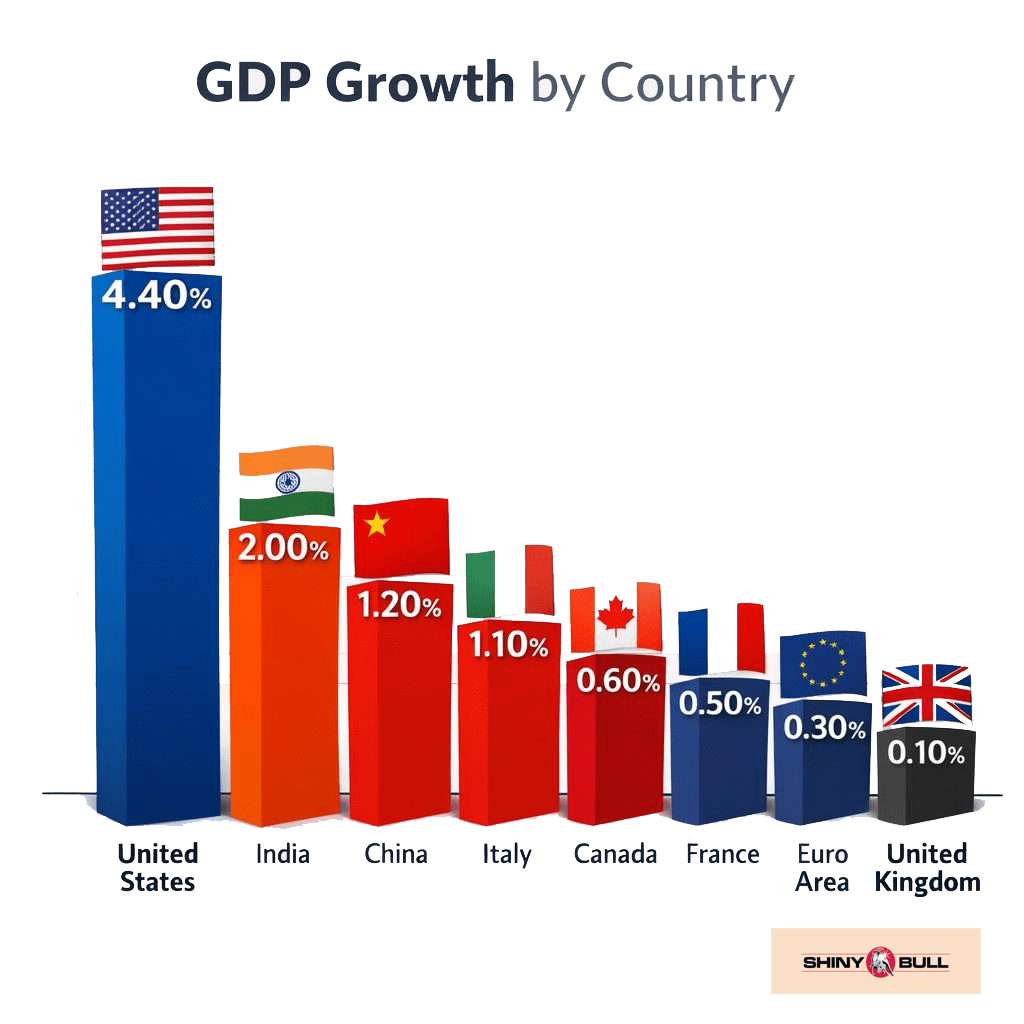

One of the primary reasons for our country’s stunning economic turnaround, the biggest in history, where the Dow Jones broke 50,000 four years ahead of schedule, and the S&P hit 7,000 where it wasn’t supposed to do it for many years, were tariffs. I used these tariffs, took in hundreds of billions of dollars to make great deals for our country, both economically and on a national security basis. Everything was working well. Countries that were ripping us off for decades are now paying us hundreds of billions of dollars. They were ripping us so badly. You all know that. Everybody knows it. Even the Democrats know it. They just don’t want to say it. And yet, these countries are now happy, and so are we. We made deals. The deals are all done, and they’re happy. They’re not making money like they used to, but we’re making a lot of money. There was no inflation—tremendous growth. And the big story was how Donald Trump called the economy correctly and 22 Nobel Prize winners in economics didn’t—they got it totally wrong.

And as time goes by, I believe the tariffs paid for by foreign countries will, like in the past, substantially replace the modern-day system of income tax, taking a great financial burden off the people that I love.

I’m also confronting one of the biggest rip-offs of our times, the crushing cost of healthcare caused by you. Since the passage of the “Unaffordable Care Act” sometimes referred to as Obamacare, big insurance companies have gotten rich. It was meant for the insurance companies, not for the people. With our government giving them hundreds and hundreds of billions of dollars a year, as their stock prices soared 1,000, 1,200, 1400 and even 1700% like nothing else. That’s why I introduced the Great Healthcare Plan. I want to stop all payments to big insurance companies and instead give that money directly to the people so they can buy their own healthcare, which will be better healthcare at a much lower cost.

I’m also ending the wildly inflated cost of prescription drugs like it’s never happened before. Other presidents tried to do it, but they never could. They tried. Most didn’t try, actually. But they tried. They said they tried. They couldn’t do it. They didn’t even come close. They were all talk and no action. But I got it done. Under my just-enacted Most-Favored Nation agreements, Americans who have, for decades, paid, by far, the highest prices of any nation anywhere in the world for prescription drugs, will now pay the lowest price anywhere in the world for drugs, anywhere. The lowest price. So in my first year of the second term—should be in my third term, but strange things happen—I took prescription drugs, a very big part of healthcare, from the highest price in the entire world to the lowest. That’s a big achievement. The result is price differences of 300, 400, 500, 600% and more, all available right now at a new website called trumprx.gov. And I didn’t name that one either, by the way.

Trump talks directly to the Democrats during the speech. Look, nobody stands up. These people are crazy. I’m telling you: they’re crazy. Amazing. Terrible Boy oh boy. We’re lucky we have a country with people like this. Democrats are destroying our country, but we’ve stopped it just in the nick of time, didn’t we?

I’m very proud to say that during my time in office, both the first four years, and in particular this last year, there has been a tremendous renewal in religion, faith, Christianity, and belief in God. Tremendous renewal. This is especially true among young people. And a big part of that had to do with my great friend Charlie Kirk. Great guy. Great man. So last year, Charlie was violently murdered by an assassin and martyred, really martyred for his beliefs. That’s right. His wonderful wife Erika, is with us tonight. Erika, please stand. Thank you, Erika. Been through a lot. In Charlie’s memory, we must all come together to reaffirm that America is one nation under God, and we must totally reject political violence of any kind.

We’re proudly restoring safety for Americans at home, and we are also restoring security for Americans abroad. Our country has never been stronger. My first 10 months, I ended eight wars, including Cambodia—[to Democrats] Isn’t it funny, sick people—Cambodia and Thailand, Pakistan and India—would’ve been a nuclear war, 35 million people said the prime minister of Pakistan would’ve died if it were not for my involvement—Kosovo and Serbia, Israel and Iran, Egypt and Ethiopia, Armenia and Azerbaijan, the Congo and Rwanda. And of course, the war in Gaza, which proceeds at a very low level. It’s just about there.

And we’re working very hard to end the ninth war: the killing and slaughter between Russia and Ukraine, where 25,000 soldiers are dying each and every month. Think of that: 25,000 soldiers are dying a month—a war which would’ve never happened if I were President. Would’ve never happened.

As President, I will make peace wherever I can, but I will never hesitate to confront threats to America, wherever we must. That’s why in a breakthrough operation last June, the United States military obliterated Iran’s nuclear weapons program with an attack on Iranian soil known as Operation Midnight Hammer. For decades, it had been the policy of the United States never to allow Iran to obtain a nuclear weapon. Many decades. Since they seized control of that proud nation 47 years ago, the regime and its murderous proxies have spread nothing but terrorism, and death, and hate.

They’ve killed and maimed thousands of American service members and hundreds of thousands and even millions of people with what’s called roadside bombs. They were the kings of the roadside bomb. And we took out [Qasem] Soleimani. I did that during my first term, had a huge impact. He was the father of the roadside bomb. And just over the last couple of months, with the protests, they’ve killed, at least it looks like 32,000 protesters, 32,000 protesters, in their own country. They shot ’em and hung them. We stopped them from hanging a lot of ’em with the threat of serious violence.

Trump is also negotiating with Iran, he said. We are in negotiations with ’em. They want to make a deal. But we haven’t heard those secret words: “We will never have a nuclear weapon.” My preference, my preference is to solve this problem through diplomacy. But one thing is certain, I will never allow the world’s number one sponsor of terror, which they are, by far, to have a nuclear weapon. Can’t let that happen.

And no nation should ever doubt America’s resolve: we have the most powerful military on earth. I rebuilt the military in my first term. We’re going to continue to do so. Also, we just approved a trillion-dollar budget. We have no choice. We have to be strong, ’cause hopefully we will seldom have to use this great power that we built together. It’s really called “peace through strength” that has been very, very effective.

And NATO countries, our friends and allies—they are, they’re our friends and they’re our allies —have just agreed at my very strong request to pay 5% of GDP for military defense rather than the 2%, which they weren’t paying. We were paying for almost all of them. Now they’re paying 5% as opposed to not paying for it. And getting that 5% was something which everyone said would never be done, could not happen. We got it really easily with one meeting and, big difference between 2% that’s not paid. We were paying the freight of many of ’em. Very few were paid up. Now 5%, then they’re paid. And everything we send over to Ukraine is sent through NATO and they pay us in full. They pay us totally in full.

And America’s Armed Forces overwhelmed all defenses and not only defeated an enemy—good fighters—to end the reign of outlawed dictator Nicolás Maduro and bring him to face American justice. And this was an absolutely colossal victory for the security of the United States. And it also opens up a bright new beginning for the people of Venezuela. We’re working closely with the new president of Venezuela, Delcy Rodríguez, to unleash extraordinary economic gains for both of our countries and to bring new hope to those who have suffered so terribly.

Two hundred and fifty years is a long time in the life of a nation. But in another sense, it’s really a mere moment in the eye of history. Two of the gentlemen we met in the gallery this evening took their first breaths one century ago. One hundred years before that, on July 4th, 1826, the author of the Declaration of Independence, brilliant Thomas Jefferson, drew his last breath. Just a single long human lifespan separates the giants who declared and won our independence from the heroes who stand among us tonight.

Everything our nation has done, everything we have achieved, has been the work of those few great lifetimes. In those brief chapters, Americans built this nation from 13 humble colonies into the pinnacle of human civilization and human freedom, the strongest, wealthiest, most powerful, most successful nation in all of history. Americans ventured out across the daunting and dangerous continent. We carved past through an unforgiving wilderness, settled a boundless frontier, and tamed the beautiful but very, very dangerous Wild West.

From empty marshes and wide open plains, we raised up the world’s greatest cities. Together we mastered the world’s mightiest industries and shattered histories, monstrous tyrannies. And we liberated millions from the chains of fascism, communism, oppression, and terror. Americans lifted humanity into the skies on the wings of aluminum and steel. And then we launched mankind into the stars on rockets powered by sheer American will and unyielding American pride. We wired the globe with our ingenuity. We captivated the planet with American culture. And now we are pioneering the next great American breakthroughs that will change the entire world.

All of this and so much more is the enduring legacy, unmatched glory of the hardworking patriots who built and defended this country and who still carry the hopes and freedoms on all of humanity’s backs. For years, they were forgotten, betrayed, and cast aside. But that great betrayal is over, and they will never be forgotten again.

Because when the world needs courage, daring vision and inspiration, it is still turning to America. And when God needs a nation to work his miracles, he knows exactly who to ask. There is no challenge Americans cannot overcome. No frontier to have asked for us to conquer. No dream too bold for us to chase. No horizon too distant for us to claim. For our destiny is written by the hand of providence, and these first 250 years were just the beginning.

From the rugged border towns of Texas to the heartland villages of Michigan, from the sun-kissed shores of Florida to the endless fields of the Dakotas, and from the historic streets of Philadelphia to right here in our nation’s capital, Washington, D.C.: the golden age of America is upon us. The revolution that began in 1776 has not ended. It still continues, because the flame of liberty and independence still burns in the heart of every American patriot. And our future will be bigger, better, brighter, bolder, and more glorious than ever before.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Shinybull.com. The author has made every effort to ensure the accuracy of the information provided; however, neither Shinybull.com nor the author can guarantee the accuracy of this information. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in precious metal products, commodities, securities, or other financial instruments. Shinybull.com and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.