Artificial intelligence is advancing so fast that some economists, technologists, and futurists believe we are heading toward a historic breaking point. Predictions range from 300 million jobs being automated to AI systems replacing everything from lawyers and teachers to software developers and journalists.

This raises a fundamental question:

If AI takes over most labor, where will people get money from, and can capitalism survive?

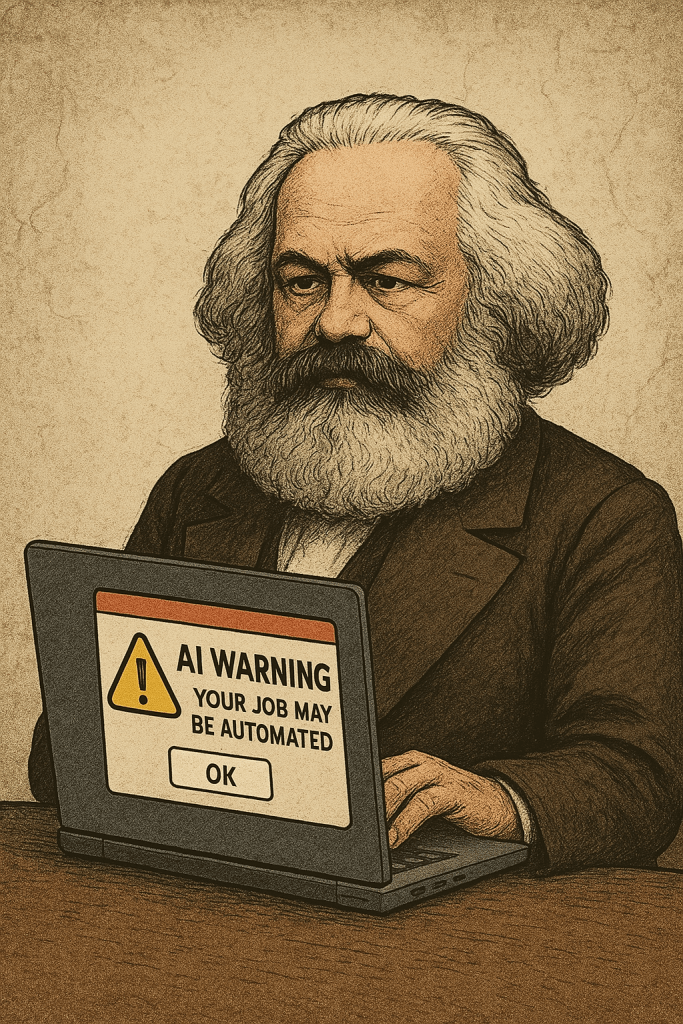

Interestingly, this debate echoes ideas written more than 150 years ago by Karl Marx, who warned that capitalism might ultimately be undermined by its own technological progress. Today, his predictions are being pulled back into the spotlight.

This article breaks down what Marx said, what AI is doing, and what the future of labor, and money, might look like.

1. What Marx Actually Predicted

Karl Marx believed capitalism had a built-in conflict:

the drive to replace human workers with machines.

He argued two key points:

A) The “Tendency of the Rate of Profit to Fall”

Marx said that profit comes from human labor.

But capitalists constantly try to replace human labor with machines because machines:

- don’t get tired

- don’t strike

- don’t demand wages or rights

The more companies automate, the fewer workers they need.

But the paradox is:

If you replace too many workers, you remove the source of profit — human labor.

This, Marx believed, would eventually destabilize capitalism from within.

B) Automation makes workers “superfluous”

Marx predicted a future where technology becomes so advanced that:

- masses of workers become unnecessary

- unemployment grows

- inequality rises

- social tensions explode

For most of history, this sounded theoretical.

Today, with AI able to perform cognitive work, Marx suddenly feels more contemporary than ever.

2. The AI Shock: Why This Time Is Different

In the past, automation replaced muscle:

- factory robots

- tractors

- machinery

Those technologies eliminated many physical jobs but created others.

AI replaces the brain:

- analysts

- accountants

- teachers

- programmers

- designers

- writers

- marketers

- customer support

- even medical diagnosis

White-collar workers, once considered “safe”, are now at risk.

Reports from groups like Goldman Sachs estimate that 300–800 million jobs worldwide could be automated in the coming years.

For capitalism, this is enormous.

Capitalism is built on two pillars:

- Labor → creates value

- Wages → let people buy things

If AI replaces too much labor, wages disappear, and the system loses its customers.

This is what worries economists.

3. The Core Economic Problem: No Jobs = No Money = No Capitalism

Here’s the simple logic:

- Companies automate work → fewer workers

- Fewer workers → less income

- Less income → less spending

- Less spending → companies lose customers

- Companies lose customers → profits fall

- Profits fall → economic system breaks

Capitalism needs consumers.

Consumers need wages.

Wages come from labor.

Labor is disappearing.

This is the exact contradiction Marx warned about.

4. What Happens to Society if AI Wipes Out Jobs?

Three major scenarios are being discussed in global economic circles:

A) Capitalism survives but transforms

Governments introduce:

- Universal Basic Income (UBI)

- AI and robot taxes

- redistribution policies

- national “AI wealth funds”

- profit-sharing models

This keeps consumers alive even without traditional jobs.

B) Extreme inequality + political instability

If nothing is done:

- wealth concentrates into a few tech giants

- middle class collapses

- consumer markets shrink

- social unrest rises

- governments face pressure for reform or revolution

This is the scenario many analysts fear.

C) A transition to “post-capitalism”

This idea doesn’t mean communism. Instead, it means a system where:

- machines produce most wealth

- humans work less or not at all

- value is redistributed through society

- the wage-labor system becomes obsolete

Some predict a peaceful shift.

Others see a turbulent transition.

5. Will New Jobs Replace the Old Ones?

Historically, technological revolutions created more jobs than they destroyed.

But AI is different for three reasons:

- It automates thinking, not just physical effort

- New jobs may require skills most people don’t have

- AI learns faster than humans can retrain

For the first time, technology is competing with humans in creativity, reasoning, and decision-making.

This makes the future less predictable than any previous industrial revolution.

6. Will AI Destroy Capitalism?

There are three main schools of thought:

1) AI will reshape capitalism, not kill it

The system adapts by creating safety nets like UBI, or by shifting focus to new industries.

2) AI will create “hyper-capitalism”

A handful of mega-corporations control all the AI models and extract enormous profits, leading to an extreme concentration of power.

3) AI will push us beyond capitalism

If machines produce nearly all value, the traditional logic of:

work → wages → consumption

falls apart.

In that case, capitalism as we know it would need to evolve or be replaced.

7. The Short Answer

If AI eliminates hundreds of millions of jobs and nothing is done, capitalism collapses because consumers vanish.

If governments and companies adapt, we enter a new economic era. Perhaps capitalism 2.0.

Marx didn’t predict AI, but he did predict the danger of a system that depends on labor while simultaneously trying to eliminate it. That contradiction is now the central question of the coming decade.

In the end, nobody truly knows where this collision between AI, labor, and capitalism will lead. Some predict unprecedented prosperity, others foresee economic collapse, and many warn that the transition itself may be chaotic.

Even politicians in several countries have started telling people to “buckle up,” hinting that families should keep basic supplies like food and water on hand. Not because disaster is guaranteed, but because the pace of disruption is now faster than society’s ability to adapt.

One thing is sure: we are crossing a threshold into unknown territory, where the old rules may no longer apply. The question is not whether change is coming, but how prepared we are for the world on the other side.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Shinybull.com. The author has made every effort to ensure the accuracy of the information provided; however, neither Shinybull.com nor the author can guarantee the accuracy of this information. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in precious metal products, commodities, securities, or other financial instruments. Shinybull.com and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.