The Korean Peninsula was inhabited as early as the Lower Paleolithic period. Its first kingdom was noted in Chinese records in the early 7th century BCE. The succeeding Korean Empire (1897 – 1910) was annexed in 1910 into the Empire of Japan.

Japanese rule ended following Japan`s surrender in World War II, after which Korea was divided into two zones: a northern zone, which was occupied by the Soviet Union, and a southern zone, which was occupied by the United States.

After negotiations on reunification failed, the southern zone became the Republic of Korea in August 1948, while the northern zone became the communist Democratic People`s Republic of Korea the following month.

In 1950, a North Korean invasion began the Korean War, which ended in 1953 after extensive fighting involving the American-led United Nations Command and the People`s Volunteer Army from China with Soviet assistance.

The war left 3 million Koreans dead and the economy in ruins.

The May 16 coup of 1961 led by Park Chung Hee put an end to the Second Republic, signaling the start of the Third Republic in 1963.

South Korea`s devastated economy began to soar under Park`s leadership, recording one of the fastest rises in average GDP per capita.

Despite lacking natural resources, the nation rapidly developed to become one of the Four Asian Tigers based on international trade and economic globalization, integrating itself within the world economy with export-oriented industrialization.

The Fourth Republic was established after the October Restoration of 1972, in which Park wielded absolute power.

The Yushin Constitution declared that the president could suspend basic human rights, and appoint a third of the parliament.

Suppression of the opposition and human rights abuse by the government became more severe in this period

South Korea has since then had a huge economic success. They have big companies like Samsung (which is the biggest company in South Korea), LG Energy Solution, Hyundai, and Kia to name a few.

On top of that, they also have BTS which is a boyband from South Korea. According to the Hyundai Research Institute, BTS was estimated to generate around $3,6 billion annually for the South Korean economy.

In some years, their direct and indirect contribution has been as high as $4,6 billion, which is comparable to major multinational corporations. BTS has been estimated to contribute around 0,3% to 0,5% of South Korea`s GDP in recent years.

This is a remarkable figure for a single music group, considering the country`s GDP was around $1,63 trillion in 2020.

South Korea`s economic success is well known all around the world, and they has become an economic powerhouse. But right now, it seems like their economic model is running out of steam. The economy has been slowing for years. It has basically stopped.

The economy in South Korea is on the way to be like Japan. What in the world is going on?

It all started in the 1950`s. Their economic growth was 10%, and it reached the top in the 1980`s. Then it began to slow. Growth in the 90`s declined to around 7%. Ten years later, the growth went down to 4%. In 2010, their growth was only 3%.

But something has happened in the last five years. The growth has been slowing year by year. This is what’s happening with the economy as they get richer. It happens in all rich countries. But, in South Korea, it seems like this is not temporary. It seems to be a new normal.

Bank of Kora (BOK) has warned that South Korea`s economy may enter negative territory in the next decade. The country is on a declining trajectory. Unless this is going to change, the next generation will be worse off than their parents.

But, how is it possible that a successful country like South Korea with so many high-tech companies can decline like this? Well, it has its own explanation. We need to look at their economic model, and how it came to be, and how it operates today.

The core of the South Korean economy is made up of something called «Chaebols». «Chae» stands for wealth or property, while «Bol» stands for clan or group.

«Chaebols» refers to large, family-owned business conglomerates in South Korea that wield significant influence over the country`s economy.

The influence of chaebols is often cited as a contributing factor to some of South Korea`s economic challenges, but they are not the sole reason for any economic decline. Several factors, including chaebols’ dominance, are at play when examining South Korea`s economic issues.

This is what we see in the U.S., but also in many other places in the West. They blame big corporations, wealthy entrepreneurs, and investors.

It is the concentration of economic power. Chaebols control a large portion of South Korea`s economy, leading to less competition. Their dominance can stifle small and medium-sized enterprises (SMEs), limiting innovation and growth in other sectors.

Chaebols have also been involved in corruption scandals, often using their power to influence political decisions. This has led to inefficiency in governance and public discontent, undermining economic reforms.

Over-reliance on Export-driven Growth is also considered to be a challenge. Chaebols are heavily focused on industries like electronics, shipbuilding, and automobiles, which are export-driven. This makes the South Korean economy vulnerable to global economic shifts and trade disputes, especially in a world where the diversification of industries is increasingly important.

They also face succession and corporate governance issues. Since chaebols are family-controlled, they often face challenges with leadership transitions between generations. This can lead to inefficiencies and financial mismanagement within these conglomerates.

Strong and independent entrepreneurs have made the wealth you and I have today. They have created products that made our lives better, and their companies have grown to be multi-billion corporations. If this is a problem for countries around the world, well, what can we say? If so, this is not the only reason why the growth is slowing.

We see the same going on in South Korea as well as in Japan and many other places. Broader factors are leading to economic challenges, and one of them is the aging population. South Korea has one of the lowest birth rates in the world, leading to a shrinking working-age population.

This demographic challenge puts pressure on economic growth and social welfare systems. This is not only happening in Japan and South Korea. It`s happening in many other places around the world.

We also have a global economic slowdown. South Korea`s heavy reliance on exports means it is susceptible to the global economic downturn. Trade tensions, especially between the U.S., and China, impact South Korea`s major industries.

On top of all that, we have technological disruption. Even though chaebols have driven much of South Korea`s technological advancements, their scale makes them slow to adapt to new digital trends and innovations compared to more agile startups.

So, what is South Korea doing to address these issues? The South Korean government has been working to implement reforms aimed at reducing chaebols’ influence, promoting transparency, encouraging innovation, and supporting small and medium enterprises (SMEs).

While chaebols have contributed significantly to South Korea`s rapid industrialization and growth, their outsized role can create imbalances in the economy, making reforms crucial for long-term, sustainable growth.

In conclusion, while chaebols are not the sole cause of South Korea`s economic challenges, their dominance and related issues do play a role in creating an environment that can hinder broader economic diversification and reform. As we can clearly see, successful entrepreneurs and large corporations can be both beneficial and problematic for an economy.

Unfortunately, we very often see that successful entrepreneurs are attacked. Especially by socialists. But we have to ask ourselves what we should do without them? Because they are the ones that are creating wealth in the long run. No socialism without capitalism. The socialists need money for the welfare system, and that money comes from entrepreneurs who make goods and services.

Entrepreneurs drive innovation, create new industries, and develop new technologies that can improve productivity. Successful businesses, especially startups, can grow into larger companies, and boost economic growth.

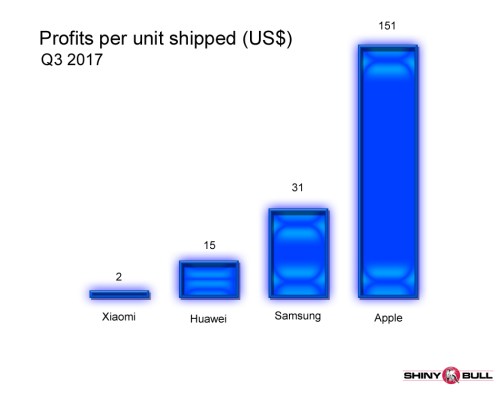

Large corporations provide millions of jobs and stimulate related industries (e.g., supply chains, and service providers). For example, companies like Apple Amazon, or South Korea`s Samsung employ a large global workforce and indirectly create additional jobs in the ecosystem surrounding their businesses.

We can see time and time again, that entrepreneurs are often the source of disruptive innovation, bringing new products and services to the market. Successful entrepreneurs can help transform entire industries.

Large corporations often have the resources to invest in research and development (R&D), leading to technological advancements. For example, tech giants like Google and Microsoft invest heavily in artificial intelligence, cloud computing, and other areas that push technological boundaries.

Multinational corporations make a country more competitive on the global stage. For example, South Korea`s chaebols (Samsung, Hyundai) or the U.S. tech giants, like Google and Apple, enhance their countries’ global influence. They also attract foreign investment and contribute to the trade balance through exports.

Successful entrepreneurs and large corporations are not inherently bad for the economy. In fact, they can drive growth, innovation, and global competitiveness. However, their dominance can lead to economic and social imbalances that harm the broader population if left unchecked. Balancing their power with fair regulations, competition, and equitable policies can be essential for sustainable economic development.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Shinybull.com. The author has made every effort to ensure the accuracy of the information provided; however, neither Shinybull.com nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in precious metal products, commodities, securities, or other financial instruments. Shinybull.com and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.