President Joe Biden tweeted this on Monday: «At the time I took office about 16 months ago, the economy had stalled and COVID was out of control. Today, thanks to the economic plan and the vaccination plan that my Administration put into action, America has achieved the most robust recovery in modern history.»

At the same time, we see that 83% of Americans describe the state of the economy as poor or not so good, according to a poll by Wall Street Journal. Biden`s poll numbers are also below those of Donald Trump. Not only that.

Another poll shows that 35% of Americans are not satisfied with their financial situation, which is the worst result in 50 years.

Biden often said that Trump was the worst president in history and an existential threat to the nation`s democracy. I wonder what he is saying about himself right now? It must be a bitter pill for an anti-Trump politician like Biden to be outclassed by the 45th president.

On April 2, Biden`s approval rating was 40% while Trump`s was at 50% the same day in 2018. Instead of gaslighting voters, Biden should clean up the messes and fix the inflation asap.

Trump`s vision was lower taxes, but president Joe Biden turned that upside down. People are paying more tax under Biden, than under Trump. On top of that, people must pay more money for their products, which is a hidden tax and makes people`s money less valuable.

Higher gas prices are good for oil companies but very bad for people and the economy. In the long run, it could kill the economy, and today, gas prices in the U.S hit a new record high of $4,91 a gallon (average price). In California, the price is $6,37 a gallon. People don`t like it, but Biden says everything is fine.

Something must be wrong here because there is a huge disconnect between president Biden and the people. And that isn`t good for the democrats at all. If this continues, GOP can win big in the mid-term election in November.

Another poll shows that the GOP is in the best midterm position in 80 years (2 pts lead), according to CNN.

Not even Liberal Media is ignoring Biden`s crisis anymore. They are also lukewarm on his potential second term.

Earlier today, Biden tweeted this: «The fact is America is in a stronger economic position today than just about any other country in the world. Independent experts have even projected that the U.S economy could grow faster than China`s economy this year. That hasn`t happened since 1976».

People`s lives are worse under Biden than under Trump. But people voted for Biden. They asked for it. They got what they asked for. Higher taxes, and inflation. President Joe Biden is the most popular president in U.S history. He got more votes than Obama and Clinton.

On the day he was inaugurated, Biden said; «Today, we celebrate the triumph not of a candidate, but of cause, the cause of democracy. The will of the people has been heard and the will of the people has been heeded.»

The love for Joe Biden was huge in the Hate Trump Media, on the day Biden was inaugurated. «The reason Biden has to do this is that he`s just so incredibly popular,» Don Lemon said on CNN at that time. «The lights from Lincoln Memorial were like Joe Biden`s arms stretching out to all American,» CNN said.

Axios said at that time in January 2021, Biden is charting an economic policy that was visible to the left of Bill Clinton and Barrack Obama. Biden proposed a $1,9 trillion economic stimulus plan and a $15 minimum wage at that time, and employers, employees, and economists warned it will kill millions of jobs.

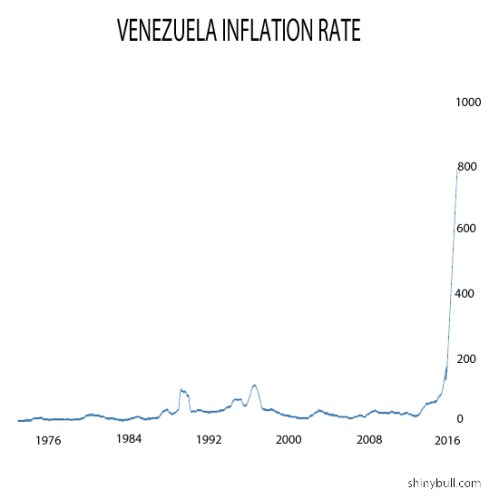

We are living in times with a lot of challenges, and more trouble is on the way. Famine is probably the most serious one. Chairman and Chief Executive of JPMorgan Chase & Co, Jamie Dimon, said a few days ago that we all must brace for U.S economic «hurricane» due to inflation. Earlier he said storm clouds looming over the U.S economy, but he has changed the rhetoric.

Right now, it`s kind of sunny, and things are doing fine, but the hurricane is right out there down the road coming our way, Dimon said. We just don`t know if it`s a minor one or Superstorm Sandy, he added.

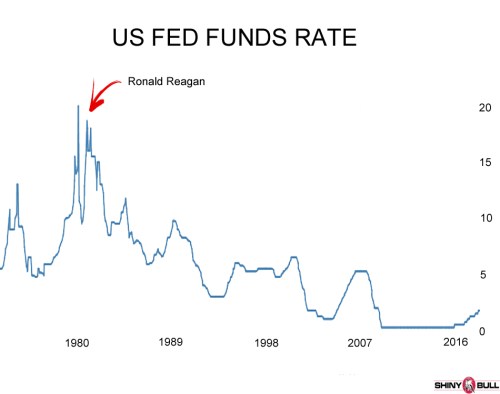

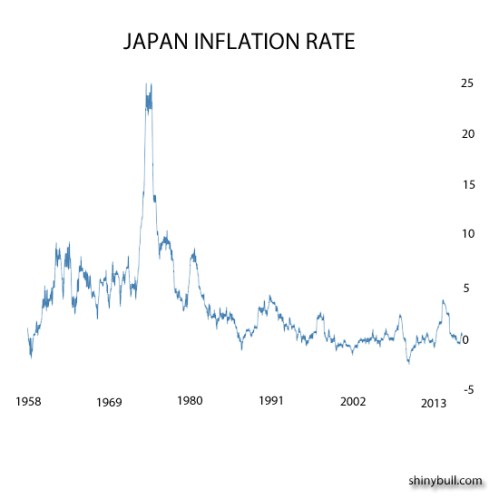

The Fed is under pressure with inflation that is more than three times its 2% target, and that has caused a jump in the cost of living for Americans. It faces the difficult task of dampening demand enough to curb inflation while not causing a recession.

Dimon urged the Fed to take forceful measures to avoid tipping the world`s biggest economy into a recession.