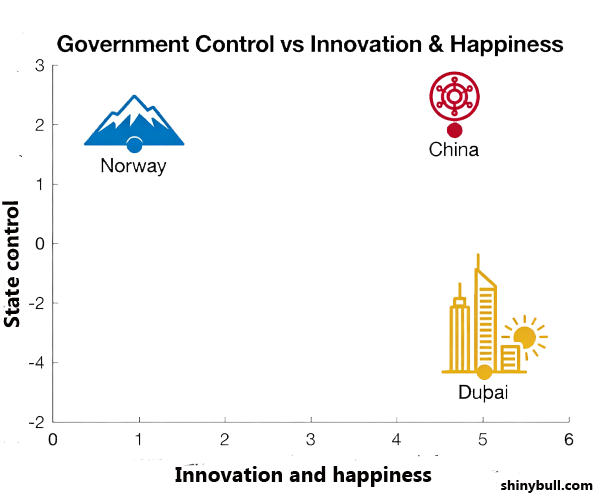

Norway is often celebrated as a rich, democratic, and socially just country. Yet, beneath the surface, many citizens feel economic pressure, high stress, and limited freedom. Meanwhile, countries like Dubai and even authoritarian regimes like China sometimes achieve outcomes that appear more “effective” for their people. This article explores the intricate relationships between wealth, freedom, democracy, innovation, and happiness, and why Norway’s oil and gas revenues are both a blessing and a constraint.

The Housing Market: Who Really Controls Prices?

In Norway, the housing market is described as “superheated,” yet homebuyers ultimately decide prices through bidding wars. The real superstars among the best entrepreneurs are the superheroes called “Real Estate Agents.” They often justify high commissions by claiming they can maximize the seller’s price, but in practice, a desirable location alone drives up bids.

Are real estate agents really working for the people? No, they are working for the seller so the people need to buy as much as possible. Are politicians on the people`s side? No.

The fact is that politicians, not buyers or agents, have the true power to influence the market through zoning, building approvals, and regulations, yet often they are not on the people’s side. What democracy is that?

Contrast with China:

Are the communists in China on the people`s side? Yes. China’s government directly builds massive cities to increase housing supply, effectively controlling availability. Result: demand is met faster, homes are more accessible, and prices stabilize.

Key Insight: Democracy on paper does not guarantee results for citizens if politicians fail to act effectively.

Democracy vs Results

Democracy is often measured by free elections and political rights, but these do not guarantee that citizens get what they want.

Examples in Norway:

- Road tolls (bompenger) implemented despite public opposition. The people doesn`t want it, but politicians do not listen to the people.

- High taxes and property regulations limiting economic freedom. The people doesn`t want high taxes, but politicians do not listen to the people. Hundreds of rich people are fleeing rich countries like Norway. They move to Dubai and Switzerland.

In China, the government may act efficiently to provide outcomes like housing, but citizens have little direct influence.

Observation: Norway excels in democratic process, while China sometimes outperforms in results, at least in targeted areas.

Freedom, Wealth, and Economic Dynamism

If citizens have access to affordable housing, low taxes, and minimal fees:

- They retain more disposable income

- They spend more, boosting businesses

- High consumption attracts talent, entrepreneurship, and innovation

This creates a self-reinforcing cycle: wealth → consumption → business growth → jobs → higher wages → innovation → productivity → more wealth.

Contrast with Norway:

- High housing costs, taxes, and fees suppress consumption and slow economic growth.

- Oil and gas revenues act as a safety net, allowing citizens to live comfortably without driving productivity or innovation in many sectors.

Key Insight: Norway has wealth and stability, but its reliance on oil reduces the pressure to innovate. A luxury few countries can afford.

Socialist Policies vs Individual Freedom

Norwegian socialists often prioritize redistribution and state control to ensure equality. However, this can limit the economic potential of individuals and reduce incentives for innovation.

Contrast with Dubai:

- Low or zero income tax

- Citizens retain wealth and spend freely

- Government collects revenue via targeted consumption taxes

Result: citizens enjoy wealth and freedom, while the state still funds infrastructure and public services. Strategic taxation allows both individual prosperity and state revenue, without stifling innovation or happiness. A lot of rich people in socialist countries are moving to Dubai now.

They`re doing it because of the great zero tax system, but also for happiness.

Oil, Innovation, and Norway’s Advantage

Norway’s wealth is largely underpinned by oil and gas revenues, which act as an economic shield. This allows:

- High living standards

- Collaboration with neighboring countries without the fear of losing competitiveness

- Reduced pressure to innovate, because the country is already rich

Consequence: Norway can enjoy the best of both worlds; resources and stability, while still pursuing innovation in selected sectors, without risking national survival. Most citizens may not even realize this structural advantage.

Norway’s wealth is partly supported by extraordinary revenues from oil and gas. This has allowed the country to build a strong welfare system and maintain high living standards. However, it also raises an important question: how dynamic would the broader economy be without this resource advantage?

Wealth vs Happiness

Norway is wealthy on paper, but high stress, depression, and widespread use of medications like painkillers and antidepressants indicate that wealth alone does not create happiness.

Dubai and other low-tax, high-freedom societies show that wealth combined with economic freedom produces higher perceived happiness, especially for those who can thrive in the system.

Conclusion: Happiness requires both resources and freedom, not just wealth or social safety nets.

The Snowball Effect: How Freedom Drives Growth

Free citizens with disposable income → high consumption → thriving businesses → more jobs → innovation → higher productivity → increased wealth.

Contrast with Norway:

Regulatory and tax pressures slow this cycle, suppressing growth and individual wealth, even though oil and gas keep the country rich.

Snowball model:

Lower taxes / affordable housing

↓

More disposable income

↓

Higher investment and entrepreneurship

↓

Innovation and new technology

↓

Higher productivity

↓

More goods and services produced

↓

Economic growth WITHOUT strong inflation

Final Thought: Norway’s Paradox

Norway is rich, democratic, and socially advanced, yet citizens often feel economically constrained. Its oil and gas revenues provide comfort, stability, and collaboration opportunities, but also reduce the need for widespread innovation.

True prosperity and happiness require not just wealth, but freedom, opportunity, and the courage to innovate. Norway may have the resources to be free and happy, but the question remains: will its citizens feel the pressure to truly flourish before the oil runs out?

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Shinybull.com. The author has made every effort to ensure the accuracy of the information provided; however, neither Shinybull.com nor the author can guarantee the accuracy of this information. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in precious metal products, commodities, securities, or other financial instruments. Shinybull.com and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.