Investors buy gold because they think that gold is a hedge against inflation. The value of the paper currency falls in terms of the goods and services that it can buy and inflation goes in the opposite direction; up.

Investors love gold when inflation is high and as you may know, gold has a direct relationship with inflation. So when inflation goes up so does the demand for gold. Imminent hyper inflation was expected during the QE program, but that is not the reality right now.

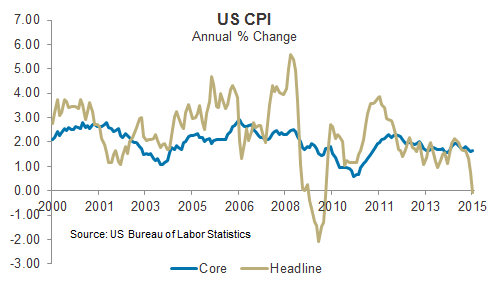

You can track inflation using the Consumer Price Index (CPI). This index measures how the price of a basket of consumer goods and services changes. CPI will give you a picture of the increase in the level of prices.

This data is released by the U.S Bureau of Labor statistics on a monthly basis. U.S inflation rate is -0,09%, (released Feb 26, 2015), compared to 0,76% in December and 1,58% last year. This is lower than the long-term average of 3,32%. Down -111,8%.

Inflation fell in January for a third straight month as U.S consumers continued to spend less on gas, food prices flattened and as costs retreated for new vehicles,used cars and trucks, household furnishings and operations, airline fares, alcohol and tobacco. U.S inflation turned negative for the first time since 2009.

The CPI measures what American pays for everything from cloths, airline tickets, fruits and vegetables to cars. Declines were again led by energy as prices at the pump tumbled about 19%. Gasoline prices have plunged 35% over the past 12 months.

A slower pace of inflation means consumers can buy more with their money, but a sustained decline over and extended period (deflation), can wreak havoc on an economy. Falling energy prices are beginning to filter down into other areas.

Core US inflation advanced 1,6% over the last 12 months, and the core 12-month reading is the benchmark inflation figure monitored by the Federal Open Market Committee (FOMC) as it helps in deciding where to set the key interests rate.

«We think inflation is going to move lower before it moves higher. Declining oil prices have had a very major influence,» Fed Chairwoman Janet Yellen said in a testimony.

The current level remains below the Fed`s 2% annual inflation target. In written remarks read to Congress, Janet Yellen stated:

“The Committee expects inflation to decline further in the near term before rising gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of lower energy prices and other factors dissipate, but we will continue to monitor inflation developments closely.”

Consumer Price Index data for February inflation and the annual period is scheduled for release on March 24, 2015.

Click the link below and check out the Fan Fund

https://www.eventbrite.com/e/fan-fund-tickets-15580655159

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Shiny bull. The author has made every effort to ensure accuracy of information provided; however, neither Shiny bull nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in precious metal products, commodities, securities or other financial instruments. Shiny bull and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.