Next week will be exiting. The earnings season is at the end and investors focus now will be on a flood of data coming in. It all starts on monday March 14 were the Bank of Japan will announce its policies.

Bank of Japan Gov. Haruhiko Kuroda is in a special situation. Just like ECBs Mario Draghi, he talked about his «bazooka» and said he wanted to do whatever it takes to get Japans economy back on track to a stable growth.

The answer so far is negative interest rate, and they started charging commercial banks 0,1% interest on some reserves last month. That lowered the borrowing cost, but on the other hand, it made some confusion about the effects on Japan`s savers.

Haruhiko Kuroda has been called to parliament for questioning many times and more than any other central bank chief during the same period. Japanese 10-year Government Bonds traded at -0,20% for the first time in history and dropped farther into negative territory.

Negative rate is also seen in Sweden, Denmark and Switzerland. Sweden`s goal is to raise the inflation. The goal in Denmark and Switzerland is to prevent the currency to raise too much.

Negative rates can be the new normal because none of them turn this situation into a strong economic growth. So, What about America?

All eyes will be on Federal Reserve Chair Janet Yellen and the Federal Open Market Committee (FOMC). The FOMC meeting will kick off on Tuesday 15, and the Fed`s interest rate decision is the highlight on Wednesday 16, with the 2 p.m ET announcement followed by a 2,30 press conference with Fed Chair Janet Yellen.

According to Wall Street Journal`s Jon Hilsenrath who is the mouthpiece of the Fed, the central bank will hold off raising rates this month, but will leave the door open for a hike in April or June this year.

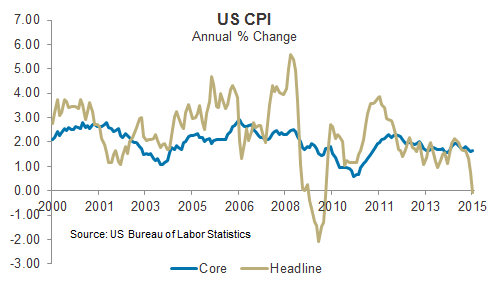

U.S Consumer prices went up 1,4% YoY in January of 2016, and the inflation rate accelerated for the fourth straight month which is very impressive. CPI for February 2016 is scheduled to be released on Wednesday 16.

The European Central Bank (ECB) followed BOJ, and increased QE by 20 billion euros per month on thursday. Not only that. They also lowered interest rates, which is an unexpectedly strong move. The ECB increased its monthly bond buying from 60 to 80 billion euros and drove commercial deposit rates from -0,30% to -0,40% and cut a main refinance rate from 0,05% to 0,00%.

As you may know, many people are very angry. Not only in Europe, but also in America. The middle class is wiped out and businessman Donald Trump knows that. He doesn`t like what he see and want to do something about it; Make America great again.

The battle for the White House continues, and next week`s Ohio and Florida primaries would give Donald Trump the knockout blow necessary to capture the GOP nomination. Anti-Trump groups are spending millions of dollar on TV ads to attack him. Is that enough to stop him? If not, it will be a short way left to the White House.

Very important week.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Shiny bull. The author has made every effort to ensure accuracy of information provided; however, neither Shiny bull nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in precious metal products, commodities, securities or other financial instruments. Shiny bull and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.