This is not speculation. This is not a conspiracy theory. It`s the truth. Former Fox News host Tucker Carlson is in Russia today. He`s in Moscow, and he plans to interview Russian President Vladimir Putin. Wow!

This will be the first conversation between Russia and Western Media since the war in Ukraine started about two years ago.

Tucker Carlson has been very critical to the war in Ukraine, including U.S. military aid to Ukraine. He also believes that most people in the West don`t really know what’s happening in Ukraine. Americans, and most people in the West are not informed, but Carlson wants to change that.

It`s time for the truth.

The war in Ukraine is a human disaster, and it has depopulated the largest country in Europe. The war has left hundreds of thousands of people dead. An entire generation of young Ukrainians, but the long-term effects are even more profound.

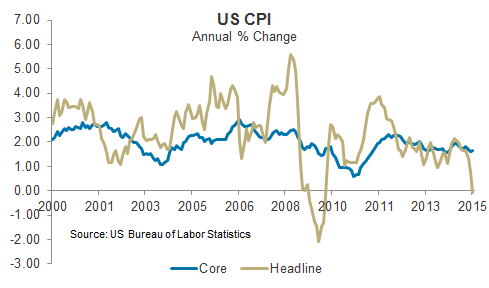

This has utterly reshaped the global military, and trade alliances, and the sanctions that followed have as well. In total, they have upended the world economy.

The post-Wold War II economic order (the system that guaranteed prosperity in the West for more than 80 years), is coming apart very fast. And along with it, the dominance of the U.S. dollar.

These are not small changes. They are history-altering developments.

They will define the lives of our grandchildren. Most of the world understands this perfectly well. They can see it. Ask anyone in Asia or the Middle East what the future looks like. And yet the populations of the English-speaking countries seem mostly unaware. They think that nothing has really changed.

They think that because no one has told them the truth. Their media outlets are corrupt.

They lie to their readers and viewers, and they do that mostly by omission. For example, since the day the war in Ukraine began, American media outlets have spoken to scores of people from Ukraine, and they`ve done scores of interviews with Ukrainian President Zelenskyy.

Most Americans have no idea what Putin invaded Ukraine, or what his goals are now. They`ve never heard his voice, and that is Wrong. Americans have a right to know all they can about a war they`re implicated in, and we have the right to tell them about it because we are Americans too, Tucker Carlson said on YouTube Tuesday.

Freedom of speech is our birthright. We are born with the right to say what we believe. That right cannot be taken away no matter who is in the White House. But, they`re trying anyway.

Tucker Carlson is not in Moscow because he loves Vladimir Putin. He`s in Moscow because he loves the United States of America.

The interview will be posted on tuckercarlson.com, X, and YouTube. But, Carlson said that the Western governments will certainly do their best to censor this video on other less-principled platforms because that`s what they do.

They are afraid of information they can’t control.

But you have no reason to be afraid of it. We are not encouraging you to agree with what Putin may say in this interview. But we are urging you to watch it.

You should know as much as you can. And then, like a free citizen, and not a slave, you can decide for yourself.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Shinybull.com. The author has made every effort to ensure the accuracy of the information provided; however, neither Shinybull.com nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in precious metal products, commodities, securities, or other financial instruments. Shinybull.com and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.