Wednesday will be a historic day. Coinbase will make stock market history as the first company specializing in cryptocurrencies to launch an initial public offering. Well, it`s not a traditional IPO but a direct listing called DPO.

This can probably be the most important IPO/DPO of 2021, and the most interesting thing about this IPO/DPO is the difference between the traditional centralized market and the decentralized cryptocurrency market.

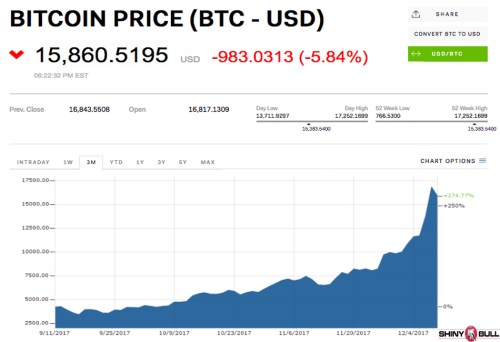

I wrote about Bitcoin 8 years ago and the price at that time was $100 – $200, and it has been a wild ride since then. The Coinbase IPO comes at a time were Bitcoin is trading at an all-time high around $63,000.

A lot of people are very sceptical about the cryptocurrency market, but this IPO/DPO can reduce this scepticizm and make more people to invest in this market which is a great alternative currency in the future.

The company is founded in 2012 but have a valuation of around $100 billion. They have 56 million users in over 100 countries, and last week, Coinbase reported a revenue of $1,8 billion for the first quarter of 2021. In 2020 they reported revenue of $1,14 billion. Up 139% from 2019.

There is great oportunities, but Coinbase also comes with its own set of risks.

The company said in its prospectus that its revenue is «substantially dependent on the prices of crypto assets and volume of transactions conduted on our platform» and that 56% of its revenue comes from Bitcoin and Etherium transactions.

Coinbase warns that if cryptocurrency prices, demand or volume declines, its business would be severely affected. While the company has established security protocols, it also noted that there is always potential for cyber attacks or security breaches.

«We have experienced from time to time, and may experience in the future, breaches of our security measures due to human error, malfeasance, insider threats, system errors or vulnerabilities, or other irregularities,» Coinbase wrote in its prospectus.

«Unauthorized parties have attempted, and we expect that they will continue to attempt, to gain access to our system and facilities, as well as those of our customers, partners, and third-party service providers.»

In addition, Coinbase cites «significant regulatory uncertainty» as one of its major business concerns, noting that regulators around the globe have increased their scrutiny of digital currencies.

A valuation of $100 billion will make Coinbase the biggest financial exchange in the world. Its operating margin of around 55% is far from that of Wall Street banks last year.

Coinbase generated 0,46% on each dollar it traded in cryptocurrrencies for customers. Last year, ICE and Nasdaq made an average of 0,01% on each dollar of securities traded. As you can see, this is big business for Coinbase, but for how long will it last?

They`re not alone in the crytocurrecy market, and sooner or later, I believe that competitors like Binance, Gemini, Kraken or Bitstamp to name a few, will follow Coinbase and push the fees down.

The operating margins for the largest investment banks is about 23%. If Coinbase drops to that level, with a revenue growth at a strong 21%, the company will be worth $18,9 billion, according to Fortune. Keep in mind that 21% revenue growth is what Nasdaq achieved in its rapid growth phase.

Keep in mind that the Coinbase IPO media is talking about is not an IPO. It is a DPO, which is a direct listing and I don`t know why media mistakenly describe it as an IPO. The difference is that IPO shares get allocated at a pre-established price. Direct listing shares do not.

In an IPO, investment bankers set the share price as high as they think the market will pay for the shares. In an DPO, there is no pre-set price dedicated by a group of investment bankers. IPO raise new capital, but direct listings do not.

The DPO will not fill Coinbase`s pockets with cash, but it will make it more easy for them to raise capital going forward. A DPO is a liquidity event. An IPO is a capital-raising event. That`s the difference.

Therefore; an IPO is less volatile than an DPO, because large institutions and other shareholders are typically locked up in the first 6-12 months. A DPO doesn`t have that kind of lockup and can dump the shares the same day they go public.

We didn`t see unexpected volatility in Spotify and Slack when they went public in their DPO, but Palantir`s shares slumped the day the lockup expired.

Coinbase shareholders will probably wait and see how trading is going before submitting their offers, and that can affect the nubmer of shares being traded and could exacerbate price swings. But that`s exactly how it is in the crypto space right now.

Coinbase has registered 114,850,769 shares eligible for sale, but nobody knows how many shares will change hands on Wednesday. It is a direct listing and the market sets the initial price. Not a group of investment bankers in an IPO. That`s exactly how it is in the crypto space. Open and transparent.

Wednesday will be a historic day and this week will be a good week for the crypto market. Let the crypto party begin.

To contact the author: post@shinybull.com