Tesla is now ready to deliver Model 3 to customers, and Elon Musk will deliver 30 Model 3 units today, friday 28th. Musk has also said he will deliver 100 cars in August and about 1,500 in September. In the long run, Tesla are planning to deliver about 20,000 Model 3 units a month.

Volume is the question here. Are they able to deliver what they have promised? Annual production was said to be 500,000 units by 2020, but Tesla said last year that they will reach that goal in 2018 which is a big jump in production from today`s annual 100,000 units.

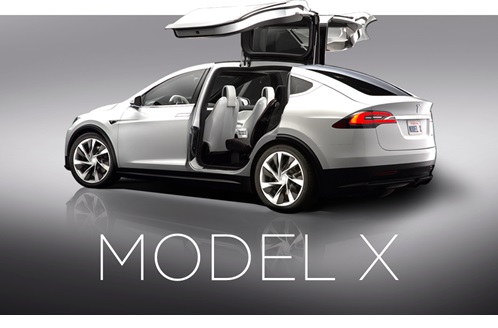

Tesla launched Model X last year but have so far seen a lot of challenges. The SUV was late to the market, and had a lot of problems with its technology. This made it difficult to produce Model X fast enough.

They have learned for that and built a new model that is much more easy to build which will give them the opportunity to reach their volume goal much faster. Can they make it? Investors will follow very closely.

Tesla Model 3 is a low-cost $35,000 vehicle. The question is: Will the demand for Model X and Model S decrease as the demand for Model 3 will rise?

It can be a bumpy road for Tesla, but the launch of Model 3 looks like a great growth plan for the company.

Tesla is expected to report earnings next week on August 2 after market close, and the report will be for the fiscal Quarter ending June 2017. Earnings forecast for the quarter is $-2 which is worse than last years $-1,54 for the same quarter.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Shiny bull. The author has made every effort to ensure accuracy of information provided; however, neither Shiny bull nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in precious metal products, commodities, securities or other financial instruments. Shiny bull and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.