The FED`s FOMC minutes, said yesterday that they could see the Fed tapering its $85 billion-a-month bond-buying program at one of the next few meetings the coming months. In addition, the committee members also saw the U.S. economy growing at a moderate pace.

This is not something new to us. They have earlier said that they want to see the unemployment rate below 6,5% and a better growth with a stabile inflation before they start to taper. Therefore, the U.S employment report in early December will be on traders and investors watch list now.

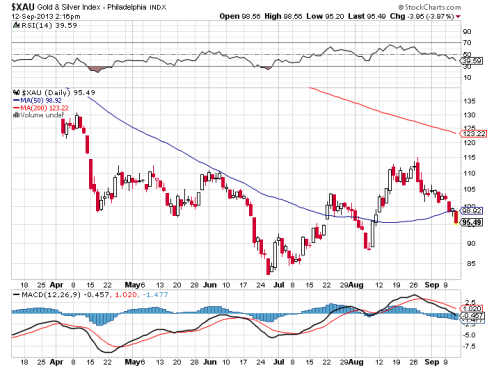

Once they came out with the news yesterday, the dollar index shot to its daily high, which is a bearish signal for the precious metals traders. Gold and silver prices dropped sharply. Where are the gold headed now?

From 1976 into the peak in 1980, gold rallied from $101,50 to $873 an ounce. A big bullish trend for the gold that time. Fear and greed are reflecting this chart, while people trade on emotions.

The gold indes peaked out and the market backed off and settled into a sideway trend from about 1982 to 1996. Then it started a sideways trend from around $281 to $514. A loooooong sideways trend for a loooong periode of time.

It went sideways in the 90`s and people considered the market to be «dead». But then the market changed in 2001 – 2002. It started a new trend that peaked out in September 2011, trading at $1900.

The chart is now very similar to the chart back in the early 80`s. If this is the future for gold, we are likely to see a sideways trend now.

But many people expect a big drop now because the market seems to be overbought. If that happend, we will se a change for the gold price. Probably a big jump. News today: PPI & Unemployment Claims at 8:30am, Philly Fed Manufacturing Index at 10:00am.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Shiny bull. The author has made every effort to ensure accuracy of information provided; however, neither Shiny bull nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in precious metal products, commodities, securities or other financial instruments. Shiny bull and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.